Pharmaceuticals is an industry that, along with financial services could be labeled as one being underpenetrated in India. However, that’s changing. The industry is currently valued at about Rs. 4.16 lac crores and is expected to hit Rs. 10.8 lac crore by 2030 [Source: https://www.investindia.gov.in/sector/pharmaceuticals]. On this growth trajectory, we identify two areas that can be tapped into in the Indian pharma space – a fall in API (Active Pharmaceutical Ingredients) prices and increased chronic drug manufacturing.

Reduction in API Prices

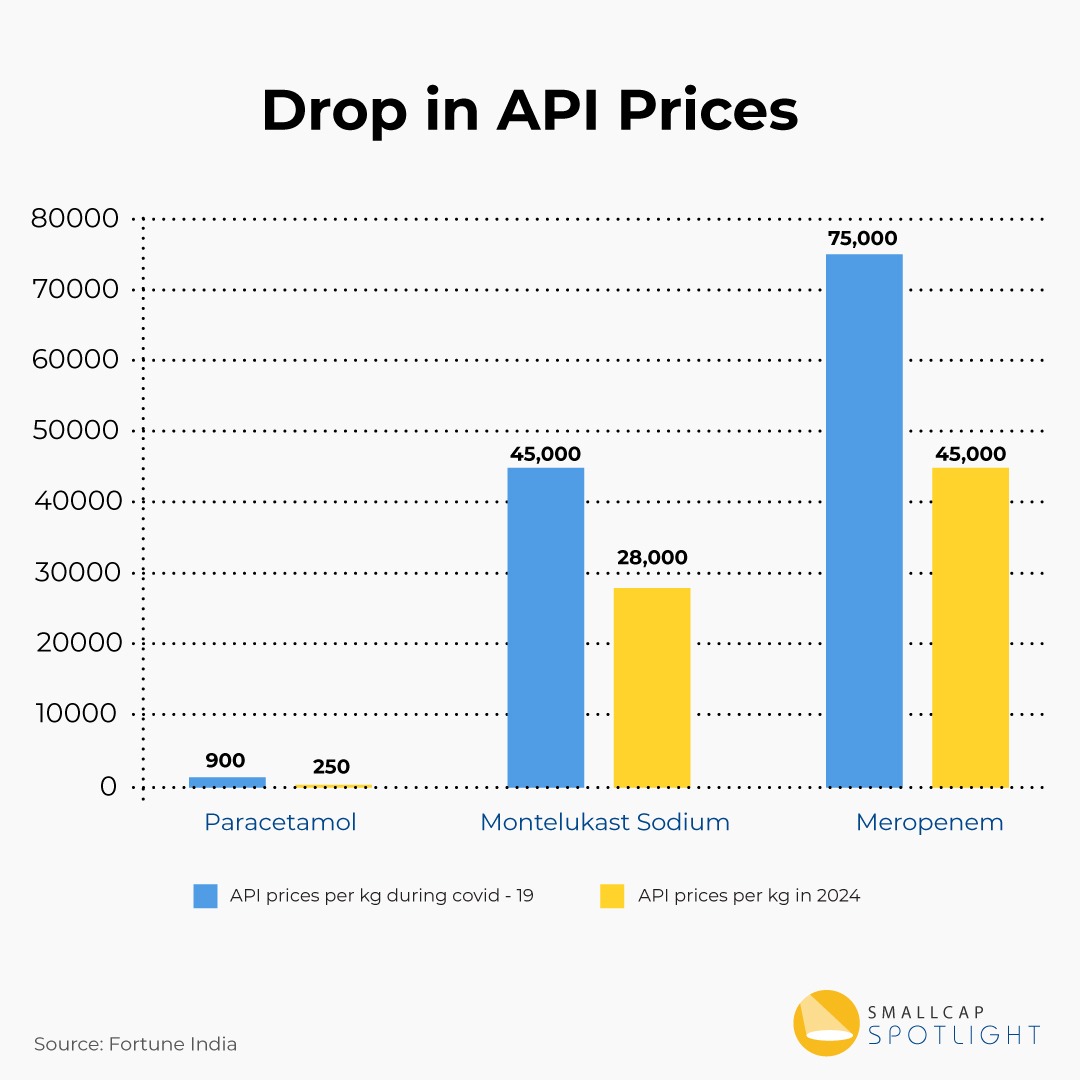

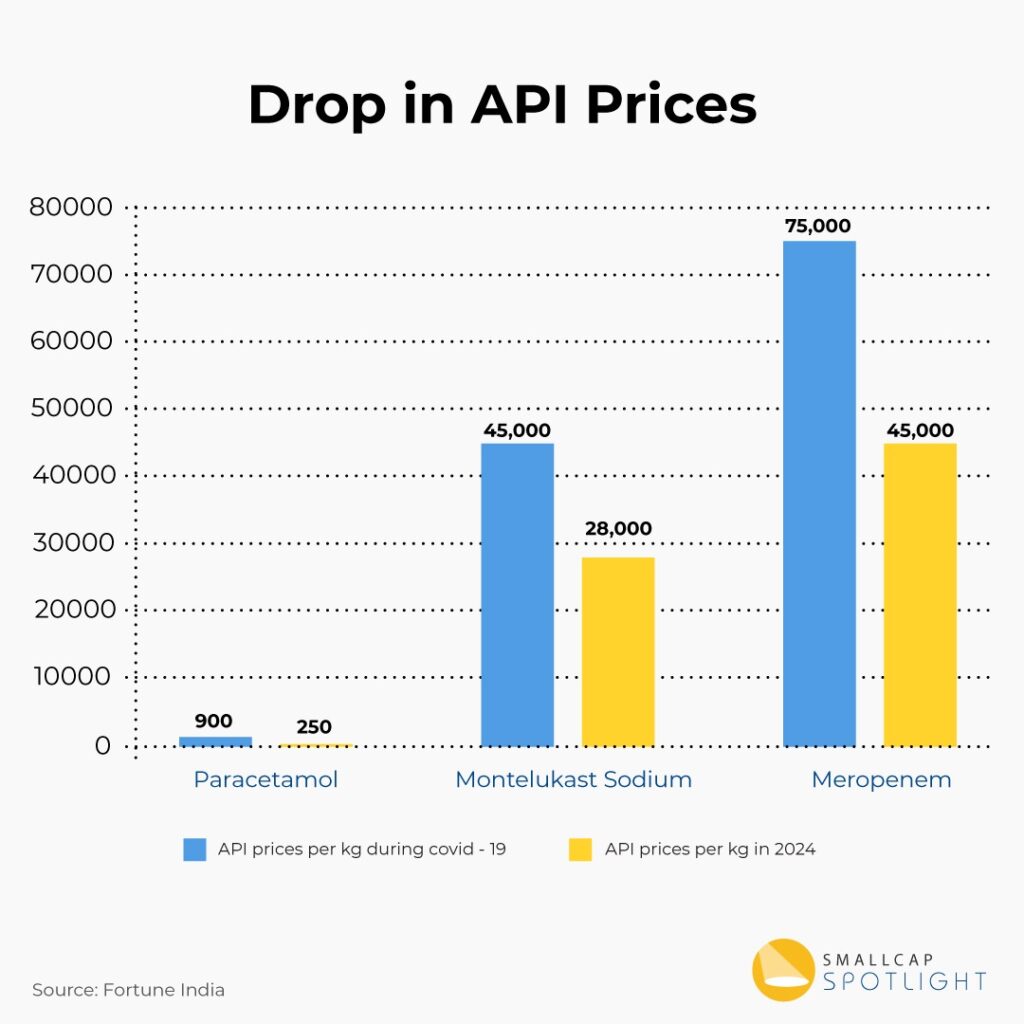

APIs that are used to formulate drugs have seen the sharpest decline in prices since COVID-19, providing much-needed relief to the pharmaceutical sector. The Indian pharma industry has witnessed a substantial 50% reduction in API expenses [note: https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/relief-for-pharma-companies-as-api-prices-see-a-sharp-fall/articleshow/109173779.cms?from=mdr]. India has also exported more quantities of bulk drugs and drug intermediates in 2022-2023 than it has imported in the same year.

The growth in the sector is fueled by the government’s Atmanirbhar Bharat campaign. The Indian pharmaceutical industry was once dependent on China for API. But with the self-reliance campaign, imports are reducing. Among the initial 13 categories chosen for this initiative were APIs. The emergence of the COVID-19 pandemic in 2020, unfortunately, saw an exponential hike in prices due to increased demand. This upward trend persisted until recently. Initiatives toward self-reliance in API production during the COVID-19 period are now yielding results, as evidenced by recent developments of API prices falling.

((Source: https://www.fortuneindia.com/opinion/chinas-api-extortion-from-indian-pharma-breaking-down/116490))

Several other factors have contributed to this, including the disruption of Chinese cartelization over the past six months, affecting both APIs and intermediates. There has been an expansion in production capacity because companies expected higher demand. However, demand actually decreased, leading to a decline in the prices of APIs.

Reduction in API Prices: The Impact

Industry experts anticipate that this shift will lead to elevated operating profit margins for companies over the next two to three quarters. They believe that the drop in API prices, especially recorded in the last two months, will revive India’s pharmaceutical industry. The decrease in prices of certain APIs might help some companies that make formulations, boosting their margins. However, it could negatively impact API manufacturers. It is important to observe this decline over a sustained period, not just short-term fluctuations. This trend might affect only a few APIs, not the entire industry.

The Spike in the Chronic Drug Market

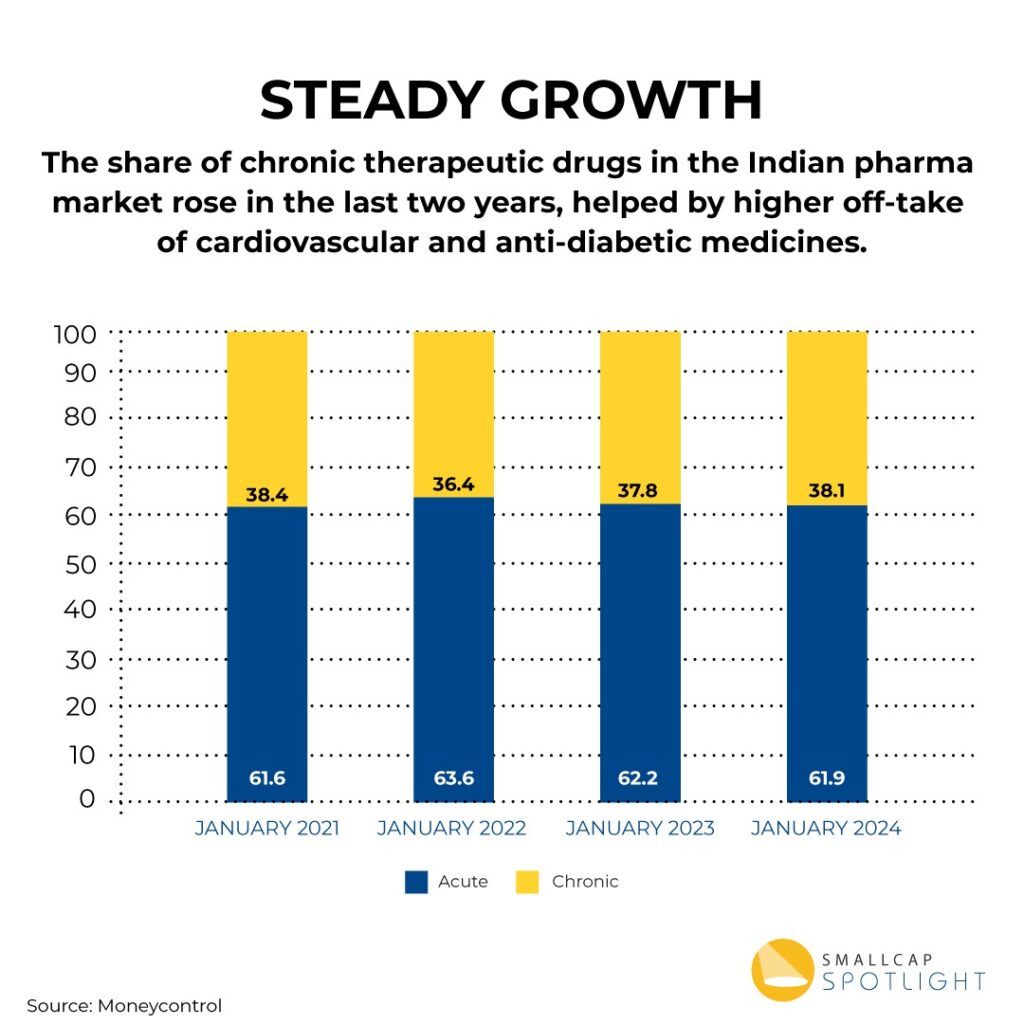

The other notable trend observed in the pharma sector is the rise in the sale of chronic medications. The Indian pharmaceutical market is experiencing a gradual increase in the proportion of chronic medications. In the twelve months leading up to January 2024, the share of chronic therapeutic drugs climbed to 38.1% up from 36.4% in the previous twelve months. Chronic medications, prescribed for conditions like cardiovascular diseases and diabetes, usually require prolonged use, spanning six months or longer. Demand for chronic medications remains more stable and less volatile compared to medications for acute conditions. The reason behind this is a rise in chronic diseases like diabetes, etc.

Companies are increasingly prioritising chronic therapeutic drugs as they observe steady growth. Some of the major drug companies aim to boost the proportion of revenue generated from chronic drugs in their overall earnings. According to experts, chronic medications are expected to sustain a robust growth trajectory, supported by the introduction of new products and increasing usage.

As big pharmaceutical companies focus more on making drugs for chronic conditions, it is likely that they will come up with better products and maybe even lower prices for consumers. This shift shows that the Indian pharmaceutical industry is slowly but steadily changing. The evolving landscape of the pharmaceutical industry, marked by adaptation and innovation, not only promises growth opportunities for companies but also ensures better healthcare outcomes for consumers.