There’s something interesting happening in the Indian automotive space: and no, it’s not just about EV growth. There’s been a flurry of activity in the auto ancillary sector — the manufacturers that supply components to the bigger OEM (original equipment manufacturers) companies, where mergers and acquisitions are on the rise.

India’s focus on sustainability and lower carbon emissions is accelerating demand for electric vehicles (EVs) and alternative fuel technologies. To keep up with this transition, companies are increasing investments in R&D and new technologies, which has led to an increase in deal activity. This shift has fuelled market consolidation, as firms join forces to leverage resources, expertise, and create long-term value in a rapidly evolving landscape.

What’s “driving” this market?

India’s auto ancillary/auto components market is witnessing strong growth, driven by multiple key factors.

Shift in consumer habits: According to the Auto Ancillary Market in India 2024-2029 report, the shift in consumer purchasing habits, especially post-COVID-19, has placed greater importance on factors like safety, driving experience, premium interiors, aesthetics, and comfort —moving beyond just price considerations. This change has created demand for advanced components and innovation.

Domestic demand: Another major contributor is the expansion of the domestic automotive sector, with increasing sales across passenger cars, two-wheelers, and commercial vehicles.

PLI schemes: Government initiatives like the Production-Linked Incentive (PLI) scheme, which emphasises local production, is also a factor.

Export potential: India’s cost-competitive manufacturing and skilled workforce are boosting its export potential, helping the auto ancillary industry secure a significant role in global supply chains.

The industry by the numbers

India’s auto ancillary market touched INR 6.14 trillion in FY 2024, with a projected CAGR (compounded annual growth rate) of 10.67% between FY 2025 and FY 2029. The sector’s rapid expansion has been fuelled by strong domestic vehicle sales, which outpaced overall production growth to create opportunities for manufacturers to expand capacity, introduce new models, and meet rising demand.

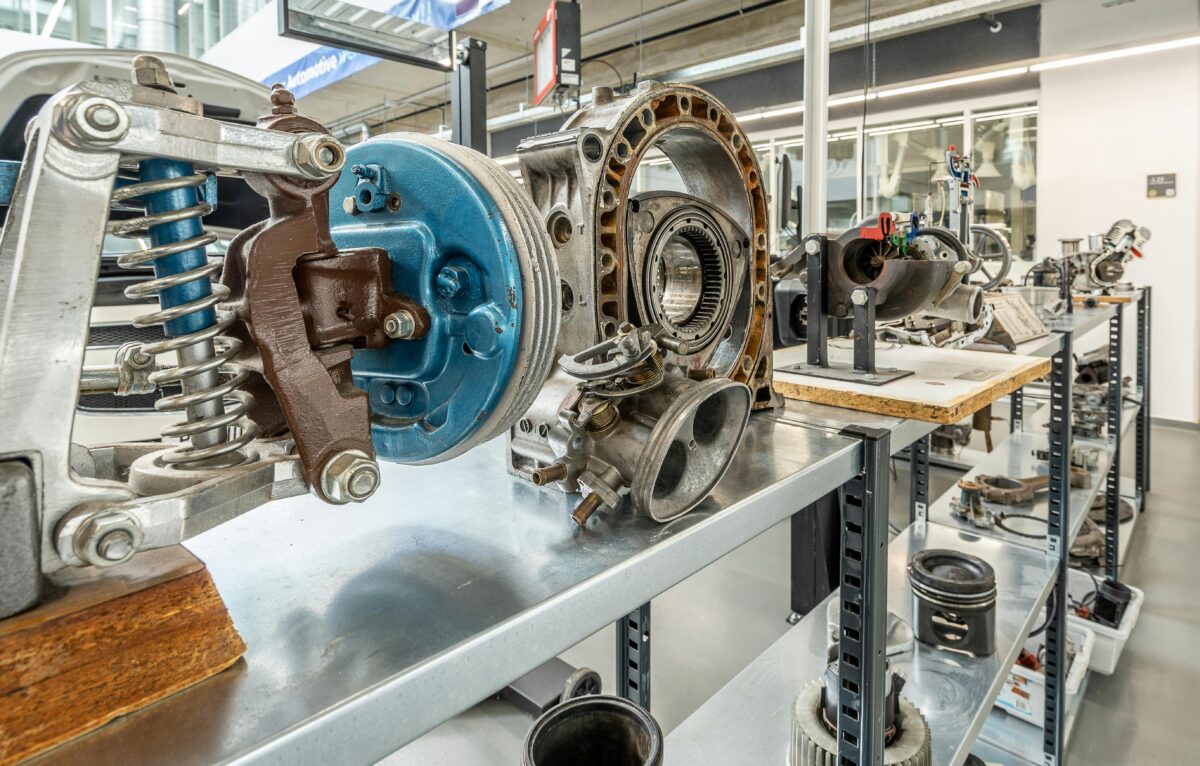

In FY 2023 and FY 2024, engine components, body/chassis, and suspension braking parts made up over 50% of total auto ancillary sales. The high demand for engine and body components has been driven by increased localisation by OEMs, a booming domestic market, and the growing need for components per vehicle.

Since FY 2022, the passenger vehicle segment has led auto component supplies to OEMs, followed by two-wheelers and LVCs (light commercial vehicles). This trend is expected to continue in FY 2025, supported by rising demand, government incentives, urbanisation, and a growing middle-class population.

How the industry is structured

Auto component manufacturers provide assemblies, sub-assemblies, and individual parts to companies that assemble the final product. Companies are categorised into Tier-1, Tier-2, and Tier-3 suppliers based on their role in manufacturing and distribution, and the supply chain looks something like this:

Tier-1 Suppliers: The companies are direct suppliers to Original Equipment Manufacturers (OEMs) and are typically large, well-established firms with advanced technical capabilities. They assemble complex components and systems, such as braking systems, exhaust systems, and transmissions, which are essential to a vehicle’s functionality and safety. Due to their close relationship with OEMs, Tier-1 suppliers often collaborate on vehicle design and development from the early stages.

Tier-2 Suppliers: These companies are medium to small-scale manufacturers that produce subcomponents for Tier-1 suppliers. They specialise in smaller, precision-engineered parts, such as fasteners, metal components, and electronic modules, which are integrated into larger systems by Tier-1 suppliers. These firms are typically located near major manufacturing hubs, ensuring a steady supply of specialised parts.

Tier-3 Suppliers: Tier-3 suppliers provide raw materials and perform essential processing services like welding, grinding, soldering, and heat treatment. This category includes both large-scale raw material providers and small specialised job shops. Tier-3 suppliers primarily serve Tier-2 companies but may also supply directly to Tier-1 firms, providing the foundational materials required for automotive component manufacturing.

This tiered structure ensures a streamlined and efficient supply chain, supporting the production of high-quality vehicles at scale.

Notable M&A activity

The last 3 years have seen demergers, acquisitions and partnerships, and these highlight the sector’s ongoing consolidation and growth.

2022: In 2022, the Motherson Group – one of India’s biggest auto components manufacturers – reorganised its companies. The domestic wiring harness business was de-merged from Motherson Sumi Systems Limited (MSSL) and became Motherson Sumi Wiring India Limited (MSWIL). MSWIL was listed on stock exchanges in 2022.

Later, Motherson Sumi Systems Limited (MSSL) merged with the holding company Samvardhana Motherson International Limited and the merged entity was renamed Samvardhana Motherson International Limited (SAMIL).

February 2023: Minda Corp., part of the Spark Minda group that specialises in automotive body electronics, strengthened its position by acquiring a 15.7% stake in Pricol for $48 million. (However in January 2024, Minda Corp. exited Pricol with a 15.7% stake sale which resulted in a profit of INR 260 crore.)

July 2023: Samvardhana Motherson International Limited (SAMIL) acquired 81% of Honda Motor subsidiary Yachiyo Industry’s four-wheeler business.

August 2023: HCL Technologies acquired ASAP Holding GmbH, a German automotive engineering services firm, for $280 million.

October 2023: ABT Transport acquired Sakthi Auto Component Limited for $83 million. In October 2023, ABT Transport Private Limited (ABT) agreed to purchase 77.04% of Sakthi Auto Component Limited (SACL) from Sakthi Global Auto Holdings Limited (SGAH). ABT Transport is the logistics arm of the Sakthi Group, and Sakthi Auto Component Limited is a firm within the Sakthi group that supplies components like steering knuckles and rotors to global auto and truck manufacturers.

January 2024: Hyundai Motor India Ltd (HMIL) signed an Asset Purchase Agreement (APA) to acquire assets at the General Motors (GM) India Telegaon Plant, 6 years after GM’s exit from the Indian market.

August 2024: Samvardhana Motherson International Ltd (SAMIL) acquired a 34% stake in Motherson Auto Solutions Ltd (MASL) from Sojitz Corporation.

December 2024: Pricol Limited, through its subsidiary Pricol Precision Products, has acquired Sundaram Auto Components’ Injection Moulding business, strengthening Pricol’s presence in the automotive sector and adding INR 730 crore to its revenue. Coimbatore-based Pricol is a key supplier to global automotive OEMs.

January 2025: Gabriel India Limited (GIL) signs an Asset Purchase Agreement (APA) with Marelli Motherson Auto Suspension Parts Private Limited (MMAS), Marelli Europe S.p.A., and Samvardhana Motherson International Limited, to acquire fixed assets and inventory from MMAS, subject to the fulfillment of specific conditions. The deal is valued at INR 60 crore.

The road ahead

As the world’s largest producer of two and three-wheelers and the third-largest in passenger vehicles, India’s automotive sector plays a crucial role in economic growth, accounting for 35% of the manufacturing GDP.

While it’s too early to tell if the auto ancillary space will experience major consolidation in the and evolve into just a few big players serving the sector, it’s clear the industry is poised for unprecedented expansion and ready to capitalise on emerging opportunities, driven by economic growth and industry-friendly policies.

Sources

https://www.just-auto.com/dashboard/deals-dashboards/india-m-a-activity-automotive-industry/