At the beginning of the new year, there is a lot of uncertainty and volatility in the economy and the financial markets. The tightening grip of higher interest rates is being felt across industries and asset classes.

Messages are mixed. The global economy faces recession while Indian entrepreneurs are still optimistic. Portfolios are listless and yet we heard in December that markets were reaching “new highs”.

At such times, it is important to remember that equity investing is a long term endeavour. While short term volatility can mislead, there are no free lunches. Just staying ahead of inflation can sometimes be a challenge.

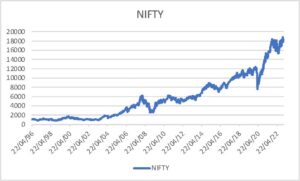

Take a look at the two graphs. The first one is the NIFTY index and the second is the same index adjusted for inflation.

The inflation-adjusted index today, i.e. January 2023 is barely a shade above its value in January 2008, i.e. 15 years ago!

As equity investors, we should not take the task at hand lightly. In order of importance and reverse order of difficulty, our objectives are as follows:

- Do not lose money

- Beat inflation

- Beat the Index